A $300 Billion Pickpocketing from the Iranian People

WANA (May 15) – The beginning of smart oil sanctions against Iran dates back to the UN Security Council resolutions in June 2010. This was followed by the European Union’s decision in January 2012 to stop purchasing crude oil from Iran, a decision that came into effect in July 2012. Consequently, the year 2013 was the first full year in which Iran’s oil sales were entirely under the shadow of sanctions.

But what impact have sanctions had on Iran’s oil exports since 2013? In fact, perhaps the question should be asked more comprehensively: since 2013, what has been the impact of sanctions, the flawed approach to confronting them, and the outbreak of COVID-19 on Iran’s oil exports—and how much oil revenue has the country been deprived of as a result?

Oil Exports Fall Below 200,000 Barrels

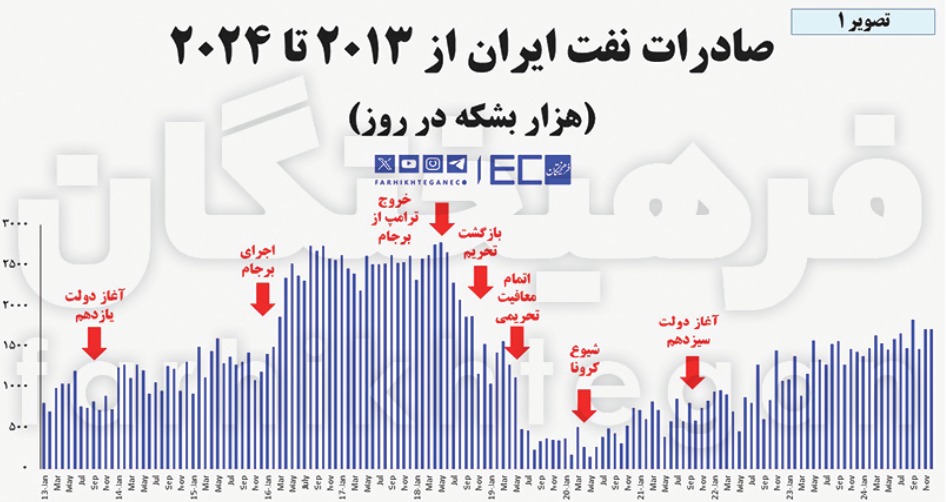

Figure 1 shows Iran’s oil exports across different months from 2013 to 2024. According to this chart—based on data from the oil tanker tracking agency Kpler—Iran’s crude oil and condensate exports stood at around 1.3 million barrels per day prior to the implementation of the JCPOA.

U.S. Imposes New Sanctions on Iran’s Oil Network

WANA (May 08) – The U.S. Department of the Treasury has announced a new wave of sanctions targeting Iran’s oil exports, including penalties against a Chinese refinery and three Chinese ports, as part of Washington’s ongoing pressure campaign against Tehran. In a statement released Thursday evening on its official website, the Treasury Department said […]

Then, in January 2016, Iran’s oil sales rose to an average of 2.3 million barrels per day. However, following Trump’s withdrawal from the JCPOA, exports fell to below 200,000 barrels per day.

Kpler’s data indicates that since 2020, toward the end of Trump’s presidency, Iran’s oil sales began to rise again, reaching a record of over 1.8 million barrels per day by 2024.

According to Figure 1, over the past 12 years, it was only during approximately three years of the JCPOA’s implementation that Iran’s oil sales reached their peak, while in the remaining nine years, the country suffered annual opportunity losses amounting to several billion dollars.

Figure 1, Iran’s oil exports from 2013 to 2024

It should be noted, however, that the implementation of the JCPOA, in addition to its “benefits,” also imposed a significant “cost” on Iran’s oil sales—a cost that became evident after Trump’s withdrawal from the nuclear deal.

If you look at Figure 1, you will see that before the JCPOA was implemented, Iran sold an average of 1.3 million barrels of oil per day in 2015.

But after Trump’s withdrawal from the JCPOA, Iran’s oil exports did not return to the previous 1.3 million barrels per day; rather, they plummeted to less than 200,000 barrels per day—even before the outbreak of COVID-19. This means the coronavirus pandemic had no role in the collapse of Iran’s oil sales.

But why, after Trump’s withdrawal from the JCPOA, did Iran’s oil exports suddenly collapse and never return to the previous level of 1.3 million barrels per day? The answer must be sought in the “JCPOA-ization” of Iran’s oil sales network.

Iran’s Oil Exports to China Hit Record High

WANA (Aug 31) – Iran’s oil exports to China have surged to an unprecedented 1.75 million barrels per day (bpd) this month, according to new data from the cargo tracking firm Kpler. This figure surpasses the previous record of 1.66 million bpd set in October 2023 and represents a 50% increase from last month’s 1.24 […]

In other words, during the JCPOA implementation period, all of Iran’s sanction-evasion networks were exposed and dismantled, which meant that following Trump’s exit, Iran’s ability to sell oil was blocked until a new network could be established.

Thus, if we consider fluctuations in Iran’s oil exports from the time of the JCPOA implementation until the end of the twelfth government as a baseline—during which the benefits and costs of the JCPOA had fully manifested—the average oil export in this period is estimated to be around 1.5 million barrels per day.

According to data from the Kepler Institute, Iran’s oil sales were about 1.3 million barrels per day in 2015, before the JCPOA took effect, which is not significantly different from this specified period.

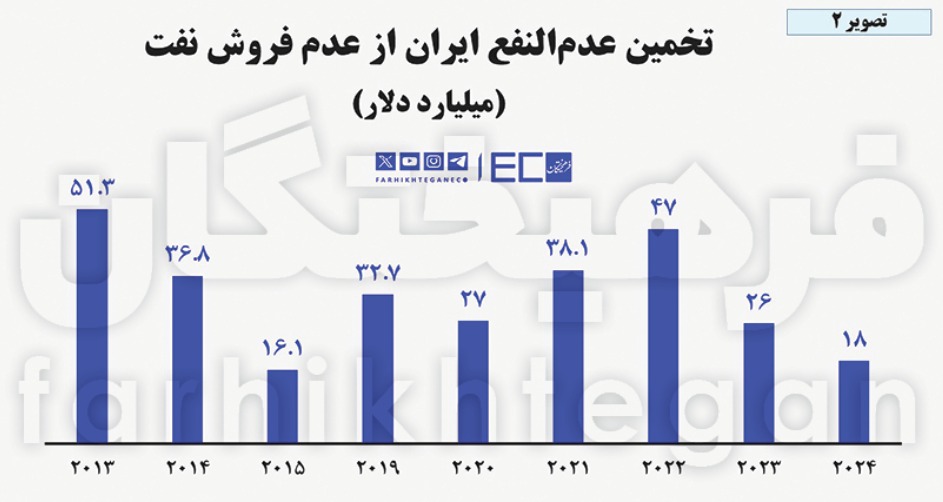

$300 billion in Oil Losses for Iran

So far, it is clear that the damage calculated from 2013 to 2024 as the country’s loss from unsold oil is not solely due to the effect of oil sanctions. The choice of an incorrect approach to confronting sanctions has also added to Iran’s lost benefits, and the COVID-19 pandemic has further impacted Iran’s lost revenues.

Now, based on this assumption, the extent of Iran’s losses from unsold oil between 2013 and 2024 is shown in Image 2. According to the calculations, Iran has suffered a total loss of $293 billion due to oil not being sold under sanctions.

Figure 2, Estimation of Iran’s loss of profit from not selling oil

The calculation method was as follows: The “unsold oil volume” was derived from the difference between Iran’s average export capacity of 2.2 million barrels per day and the actual average daily oil sales for each year.

This figure was then multiplied by the price of Iran’s heavy crude oil in each respective year, based on OPEC statistics, and the annual loss was calculated by multiplying the result by 365 days. The table includes a detailed breakdown of these calculations.

$26 Billion Annual Drop in Iran’s Oil Revenue

The losses resulting from “oil sanctions,” “misguided policies in dealing with sanctions,” and “COVID-19” fall into two categories:

- The decline in the volume of Iran’s oil exports

- Drop in the selling price per barrel of Iranian oil

According to the table, from 2013 to 2024, Iran has incurred approximately $293.3 billion in losses due to unsold oil and an additional $16.4 billion due to offering discounts on oil sales.

For simplification, the discount per barrel was assumed to be $5. As a result, Iran’s total oil-related losses have reached nearly $310 billion, which equals an annual average loss of about $26 billion from 2013 to 2024.

Realization of Oil Revenue Jumped from 15% to 67%

An indicator that shows the efficiency of each approach in dealing with sanctions is called the “Realization of Oil Revenue Compared to Total Revenue Capacity.”

This indicator measures how much oil revenue Iran has generated under sanctions, and how much it could ideally have generated without sanctions, and then divides these two numbers to define the index.

According to Figure 3, in 2020, the combined effect of sanctions and the transparency of the JCPOA on the strategies to bypass sanctions resulted in only 15.5% of Iran’s ideal oil revenue capacity being realized. This index rose steadily from 2021 and reached over 67% in 2024.

Figure 3, Realization of oil revenues relative to total capacity

Iran Became the Largest Maritime Oil Exporter to China

At the beginning of the year 2021, under the leadership of the regime, a 25-year cooperation agreement between Iran and China was signed. Subsequently, during the 13th government, the level of cooperation between the two countries increased.

According to statistics from the Kepler Institute (Figure 4), this led Iran to become the largest supplier of oil to China via sea routes in 2024, exporting 1.482 million barrels of oil per day to China. Meanwhile, the daily oil exports to China from Saudi Arabia, Russia, and Iraq were recorded at 1.393, 1.332, and 1.201 million barrels, respectively.

Thus, the shift in Iran’s foreign policy approach toward cooperation with China and the establishment of multiple oil sales networks caused the index of “realization of oil revenue relative to total oil revenue capacity” to increase from 15.5 percent in 2020 to over 67 percent in 2024.

This indicates that although the effect of sanctions on oil sales has not been completely eliminated, by defining strategic cooperation with other countries, their impact can be significantly reduced or neutralized.

Figure 4, Volume of China’s oil imports from various sources